Your driving score needs to be at a minimum of 50. If it falls below this, we may contact you and advise that you have 3 weeks to bring your score back up to 50 or above, to prevent any action being taken.

Telematics Insurance

What's covered with your telematics insurance policy?

1st Central Connect is our telematics-based policy that helps you drive more safely. Safer driving could earn you cheaper premiums at renewal.

What’s 1st Central Connect?

1st Central Connect uses a telematics app and a small sensor to look at how, when and where you drive. It offers a personalised price at renewal, based upon your driving during the policy year. It is sometimes known as 'black box’ car insurance.

Your issue:

1st Central Connect uses a telematics app and a small sensor to track your driving. We’ll measure a number of things, including how, when and where you drive, to offer you a personalised renewal price. This is a type of ‘black box’ insurance, but unlike traditional policies, you can easily install the sensor yourself – no engineer needed.

STEP 1

Once you’ve bought your policy, download the app.

STEP 2

Install your sensor and link it to your phone.

STEP 3

Good to go! Start driving and get real time feedback via the app.

STEP 4

Safer driving may mean better discounts at renewal.

Some telematics policies need an engineer to fit the 'black box' device in your vehicle.

However, with 1st Central Connect, there’s no need for a black box or engineer call out. Our telematics equipment is a little sensor, which you attach to your windscreen and link to your app. In less than 5 minutes, it's set up and you’re ready to go.

1st Central Connect is designed with young or inexperienced drivers in mind, it can help you drive more safely and in return, you could earn a more personalised premium at renewal.

Benefits of 1st Central Connect

Beyond potential savings at renewal, there are lots of great day-to-day benefits too.

Track your score and get feedback on your driving

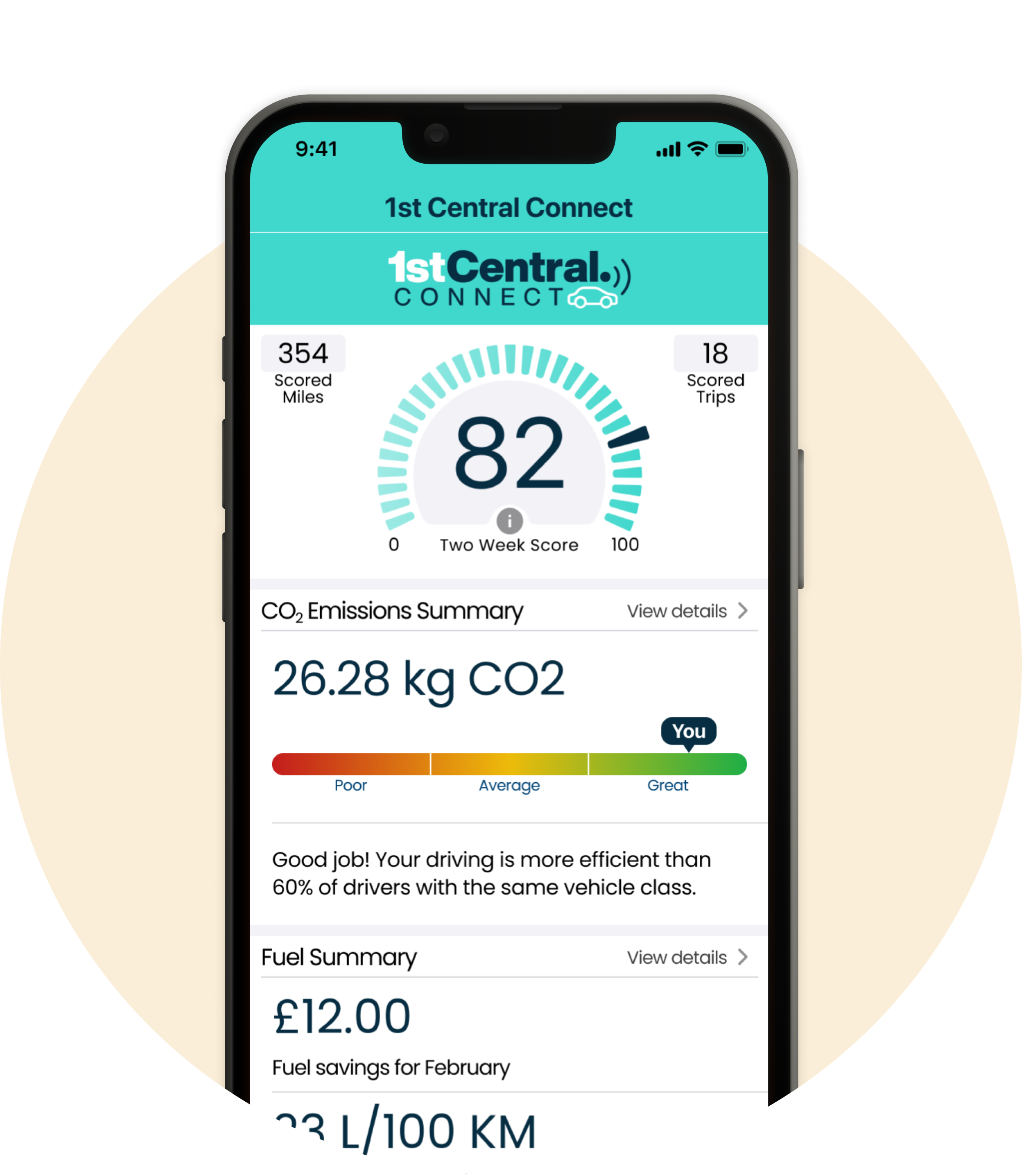

The app provides detailed feedback on each journey you take. You can see your driving score, details of your route, your trends and tips on where and how to improve.

Crash detection

If you’re involved in a crash, the sensor may detect it and prompt an alert in your app. It may also provide 1st Central with details of your crash so that we can help process and settle your claim quicker and more efficiently.

Optional eco-driving feature

See how your fuel economy and carbon emissions compares to others with similar vehicles, and get tips to help save money at the fuel pump.

.png)

Compare what's covered

See what 1st Central Connect will cover you for and compare this with our other car insurance products.

Filter our car insurance products by cover type:

1st Central Value

All the essentials at a lower price.

Here's what's covered

-

Includes: All standard benefits

-

Does not include: Sound Equipment Cover

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Includes: Medical Expenses

-

Includes: Hotel Expenses (Up to £500)

-

Includes: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Connect

Our telematics-based insurance cover, you could save money for safer driving.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Child Seat cover (Up to £250 per seat)

-

Includes: Sound Equipment Cover (Unlimited)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Includes: Medical Expenses

-

Includes: Hotel Expenses (Up to £500)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £250)

-

Includes: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Connect

Our telematics-based insurance cover, you could save money for safer driving.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core

Our standard insurance, which includes the likes of Key Assist Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover (Up to £1000)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Does not include: Medical Expenses

-

Includes: Hotel Expenses (Up to £200)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £200)

-

Includes: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core

Our standard insurance, which includes the likes of Key Assist Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core + Legal

Our standard insurance with the added protection of Legal Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover (Up to £1000)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Does not include: Medical Expenses

-

Includes: Hotel Expenses (Up to £200)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £200)

-

Includes: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core + Legal

Our standard insurance with the added protection of Legal Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core + Breakdown

Our standard product with an additional benefit of RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover (Up to £1000)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Does not include: Medical Expenses

-

Includes: Hotel Expenses (Up to £200)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £200)

-

Includes: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core + Breakdown

Our standard product with an additional benefit of RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core Premier

Our most inclusive package with both Legal Cover and RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover (Up to £1000)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Does not include: Medical Expenses

-

Includes: Hotel Expenses (Up to £200)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £200)

-

Includes: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Core Premier

Our most inclusive package with both Legal Cover and RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra

Our car insurance, with enhanced features and benefits.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Child Seat cover (Up to £250 per seat)

-

Includes: Sound Equipment Cover (Unlimited)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Includes: Medical Expenses

-

Includes: Hotel Expenses (Up to £500)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £250)

-

Includes: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra

Our car insurance, with enhanced features and benefits.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra + Legal

...with the added protection of Legal Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Child Seat cover (Up to £250 per seat)

-

Includes: Sound Equipment Cover (Unlimited)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Includes: Medical Expenses

-

Includes: Hotel Expenses (Up to £500)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £250)

-

Includes: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra + Legal

...with the added protection of Legal Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Does not include: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra + Breakdown

...including RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Child Seat cover (Up to £250 per seat)

-

Includes: Sound Equipment Cover (Unlimited)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Includes: Medical Expenses

-

Includes: Hotel Expenses (Up to £500)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £250)

-

Includes: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra + Breakdown

...including RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Does not include: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra Premier

...with both Legal Cover and RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Child Seat cover (Up to £250 per seat)

-

Includes: Sound Equipment Cover (Unlimited)

-

Includes: Vandalism Cover

-

Includes: Courtesy Car

-

Includes: Medical Expenses

-

Includes: Hotel Expenses (Up to £500)

-

Includes: Accidental Damage

-

Includes: Windscreen Cover

-

Includes: Personal Belongings (Up to £250)

-

Includes: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

1st Central Extra Premier

...with both Legal Cover and RAC Breakdown Cover.

Here's what's covered

-

Includes: All standard benefits

-

Includes: Sound Equipment Cover

-

Does not include: Vandalism Cover

-

Does not include: Courtesy Car

-

Does not include: Medical Expenses

-

Does not include: Hotel Expenses

-

Does not include: Accidental Damage

-

Does not include: Windscreen Cover

-

Does not include: Personal Belongings

-

Does not include: Personal Accident

-

Includes: RAC Breakdown Cover included

-

Includes: Legal Expenses Cover (Up to £100,000)

Comprehensive policies include:

- Free courtesy car

- Lost or stolen key cover

- 5 year repair guarantee

- Liability to others

- Driving abroad

- Accessory cover

- Accidental damage

Third-party, Fire & Theft policies include:

- Lost of stolen key cover

- Liability to others

- Driving abroad

- Third-party, Fire & Theft

If the accident wasn’t your fault, you can claim back your losses from the other driver’s insurance. With Legal Expenses Cover, our legal team will help claim these losses for you.

If another driver takes you to court, we’ve got you covered. We’ll provide up to £5,000,000 to help you defend yourself.

Legal Cover also helps with other expenses not covered by standard car insurance if an accident wasn’t your fault. For example, if you can't work because of the accident, uninsured loss recovery can help you get back up to £100,000 of your lost income.

- Replacement of keys when lost, stolen or accidentally damaged (including immobiliser, infra-red handset or alarm if it can’t be reprogrammed)

- All your car, home and office keys on your keyring

- Locksmith charges

- New locks if it's determined that your key claim represents a security risk

- If your car is unusable, up to 3 days' of reasonable travel expenses at £50 per day while your keys are being replaced

- Multiple claims across the policy term, totalling £1,500 per period of insurance

- Claims up to £100 where the keys are locked inside a property or vehicle or broken in the lock or ignition

- If you’re stranded due to keys being lost, accidentally damaged or stolen, up to £300 towards onward transportation costs to your destination

Don't worry, a key claim won't show as a claim and won't impact your No Claims Discount on your main motor policy

Please note Key Assist Cover doesn’t provide cover for keys damaged over time by wear and tear, non-accidental damage and general maintenance of insured cars keys or locks

Answers to important questions

What does the 1st Central Connect app detect and measure?

The 1st Central Connect app detects and measures a number of things, including:

Phone usage while driving - The app will detect if you are using your phone whilst you are driving. This will affect your driving score and may lead to cancellation. It’s important to tell us if a passenger has been using your phone or it could negatively impact your score. You can do this quickly and easily in the app.

Speeding - Your driving score will be affected if you go over the speed limit. Always keep an eye on your speed and be aware of what the speed limit is. Excessive speeding may result in the cancellation of your policy.

Braking - The app will detect any hard or fast braking you make. Allow yourself enough time to break gradually, so you have plenty of time to react.

Cornering - Quick or hard turns when taking a corner can affect your driving score. So always try to drive smoothly and precisely around corners.

Hard acceleration - Your driving score will be affected if you accelerate too quickly. Smooth acceleration is best, it not only gives you more time to spot hazards and but it uses significantly less fuel – saving you money in the long run.

What happens if I have a low driving score?

How does my additional driver set up the 1st Central Connect car insurance app?

It’s easy for additional drivers to set up the 1st Central Connect app.

They simply need to go to the welcome text message they received from 1st Central Connect, download the 1st Central Connect app to their smartphone, and make sure they say yes to those cookies and permissions!

It’s important that they register using their own mobile number and not with their email address – this is so we can set them up with a unique driver record on the app.

A copy of the 1st Central Connect installation guide can be found here.

For any queries please contact our 1st Central Connect team.

What happens if my trips aren't recording on the 1st Central Connect app?

When using the 1st Central Connect app with the sensor, some trips may be flagged as 'sensor only' when your smartphone doesn't connect to the sensor and record the trip. This can happen sometimes and may be caused by one of the following factors:

- Your phone was not present

- Your phone had a low battery (below 20%) or went into Power Save mode

- Bluetooth settings were disabled

- Location settings were disabled

- The trip was short and the Bluetooth connection was unusually slow

- Your Region and Language settings aren't set on United Kingdom (This can be found in your settings)

- If you have the WI-FI upload only setting turned on and haven't connected to WI-FI

The location data won't be collected for these trips, so they can't be displayed on a map. They won't be included in your driving score, but there is data gathered that could be included.

We’ll continue to monitor the journeys made without the 1st Central Connect app working. You and any additional drivers must ensure you always have your phone in the vehicle when driving, and make sure that the app and sensor are connected, otherwise, your car insurance may be at risk of cancellation.

Is my phone compatible with 1st Central Connect car insurance?

Smartphones must be running on operating systems Android 8 or later, or IOS 12 or later. They must also have a gyroscope.

What is a gyroscope?

A gyroscope is a sensor, which along with the 1st Central Connect sensor helps us to build a complete picture of your driving by measuring acceleration and rotation.

Some older or entry level smartphone models don't have a gyroscope: for example, some of the Samsung A range, or some Huawei models. You can check your device specifications or manual to see if yours does.

If you have purchased a 1st Central Connect policy, but any driver named on the policy does not have a compatible smartphone, you can call us on 0333 043 1220 or chat to us via web chat.

Ready to start your journey with 1st Central Connect?

The road to safer driving - and better value renewals - starts here.

What our customers think

Join our satisfied customers.

Ease. It's central.

“It was a very easy transition from previous insurer. The online service was straight forward too and I got covered without having to speak to anyone. The range of cover was excellent, so that’s why I chose 1st Central”.

Real people. It's central.

“I’ve been with First Central for 2 years and their customer service has been really good anytime that I’ve had to contact them. I love how I get to talk to a real person when I need to. They are supportive and provide great advice”.

Fair price. It's central.

“Their pricing is fair and the customer experience reminds me of a time when service really mattered. They're a refreshing touch in this modern age”.

Understanding. It's central.

“I passed my driving test in 2020, and my first insurer kept putting my price up. 1st Central were very understating of my situation as a first-time driver and will contact me if they see if I am struggling with payment…I think that is very considerate, and I really appreciate the support”.

Excellent service. It's central.

“The price for my cover is very reasonable for the level of cover I receive, and the customer service is excellent. Anytime I’ve had a to call the response times have been great and the advisor was very helpful”.

Support. It's central.

“I’ve only ever had insurance with 1st Central. The price has been reasonable, and I’ve also been given the support I needed throughout my time of being a customer, so I’ve never felt the need to move”.